Planning a conference is like putting together the innards of a fine wristwatch. Planners put together the event’s crucial details—venue contracts, speaker logistics, marketing, and so on—and they must carefully layer together every element, cog by cog. One slip of the hand (like a day-of technical issue), and the clock won’t work— and neither will your event.

A botched budget is one of the challenges that can bring your event to a grinding halt. Recent research showed 47% of event planners cite cost as the most important factor in event decisions. So, it’s no surprise that conference budget tracking has become one of the most time-intensive administrative tasks — and the more time conference planners spend tweaking the budget, the less bandwidth they have for strategic planning and attendee experience.

As a planner, if you’re managing multiple events annually with a small team, you’re facing additional challenges: pressure to generate revenue while controlling costs, reporting demands from leadership, real-time visibility issues, and data management chaos across multiple spreadsheets and tools.

Fortunately, the right conference budget template can help teams put all the pieces in place. Here, you’ll get guidance to build your conference budget from scratch, track the right categories and metrics, and avoid common pitfalls that plague even experienced planners.

Conference Planning Budget: Costs by Event Size

Conference costs vary dramatically based on attendee count, duration, and programming complexity. Research shows that conferences typically run for three days, though your actual duration will significantly influence costs. Here’s what to expect across different event scales:

Small Event (100-300 attendees): $15,000-$50,000

- Format: 1-2 days, single venue, regional speakers, basic AV setup

- Best for: Workshops, training sessions, small annual conferences, chapter meetings

- Key costs: Venue rental with basic setup, simplified catering (coffee breaks, one meal option), standard AV package, marketing budget

Medium Event (300-1,000 attendees): $250,000+

- Format: 2-3 days, hotel or convention center, multiple session tracks, keynote speakers

- Best for: Annual conferences, professional development events, regional meetings

- Key costs: Multi-room venue with extensive setup, full catering service, professional AV for multiple rooms, dedicated marketing campaign, speaker travel, and honorariums

Large Event (1,000-2,000 attendees): $500,000-$1 million

- Format: 3-5 days, large convention center, extensive programming, exhibition floor

- Best for: National conferences, international events, industry trade shows

- Key costs: Convention center rental with substantial space, comprehensive F&B for thousands, sophisticated AV and technology infrastructure, major marketing investment, high-profile speakers, and exhibition floor management

Important Note: These ranges reflect in-person events in major U.S. cities. Actual costs will vary based on location, season, and specific venue choices. Events in secondary markets typically run 30-40% lower than those in major metropolitan areas.

How to Build Your Conference Budget Template (Step-by-Step)

Phase 1: Establish Your Budget Framework

Before diving into line-item costs, establish the high-level framework that will guide your spending decisions. According to industry data, large conferences are typically booked more than three years in advance, while smaller meetings require at least six months of lead time—which further underscores the importance of early budget planning.

Whether you’re creating an event budget template from scratch or adapting an existing one, these principles apply universally.

Follow the 60/30/10 Budget Rule

While the 60/30/10 rule started as a spending framework for personal finance, it’s also a great starting point for conference budgets:

- 60% Essential Costs: Venue, food and beverage, AV, core logistics

- 30% Experience and Marketing: Attendee engagement, promotions, materials

- 10% Contingency: Unexpected costs, emergencies, last-minute opportunities

For larger or more complex events, consider this alternative:

- 70% Direct Event Costs: Everything attendees directly experience

- 20% Revenue Generation Investments: Marketing, sponsorship fulfillment, sales efforts

- 10% Contingency and Innovation: Buffer for changes and new initiatives

Define Your Event Goals

Once you have your budget framework, establish the overarching goals for your event. Set these critical metrics early in your planning process:

- Attendance goals: Be realistic based on historical data or comparable events. Overestimating attendance is one of the fastest ways to blow your budget.

- Revenue targets: What do you need to earn? Break even? Generate 15-20% profit? Cover organizational costs? Your revenue target shapes every other decision.

- Fixed vs. variable costs: Fixed costs (venue rental, AV package, speaker fees) don’t change based on attendance. Variable costs (like meals, materials, and swag) scale alongside the number of attendees. Understanding this distinction helps you adjust quickly if registration underperforms against your projections.

Phase 2: Map Revenue Projections

Revenue planning requires more than multiplying ticket prices by the expected attendance. Rather than doing napkin math, build a comprehensive revenue model.

Create Your Registration Pricing Strategy

Use tiered pricing to create urgency and maximize revenue:

- Early bird tier: Offer a 10-25% discount off standard pricing. Open early registration 3-6 months before the event and close it 60-90 days out. Despite the scarcity and urgency of early-bird offers, industry data shows that the majority of event registrations generally happen at the standard pricing tier.

- Standard tier: Your full price baseline. Most registrations occur here, so price this tier carefully based on value delivered and competitive positioning.

- Late/onsite tier: Add a 15-20% premium over standard pricing. This encourages earlier registration and offsets last-minute logistical costs. According to PCMA/Maritz research, 45% of attendees register less than 4 weeks before the event, with 9% registering on-site.

To maximize registration completion rates across all pricing tiers, consider implementing a few strategies to reduce cart abandonment during the checkout process.

Establish a Sponsorship Revenue Strategy

Create a structured sponsorship program with 4-6 defined levels, each offering tangible benefits. Include specific deliverables at each tier: logo placement, speaking opportunities, booth space, attendee list access, and social media promotion.

Set realistic sponsor limits per level—scarcity creates urgency. If you offer unlimited “Gold” sponsors, there’s no incentive to commit early.

Build in some “sold out” tiers to create urgency for future events and demonstrate program success to prospects.

Pursue Additional Revenue Streams

Look beyond registration and sponsorship to bring in income. Consider one (or multiple) of these tactics to bring in extra revenue:

- Exhibitor fees: If your event includes an exhibition floor

- Add-on experiences: Pre-conference workshops, VIP dinners, exclusive networking sessions

- Continuing education credits: CE processing fees for healthcare, legal, or professional development events

- Merchandise: Event-branded items or industry-specific products

Phase 3: Track These Cost Categories

With 5-10 vendors to manage per event, organizing your expenses by category is essential to retain control over your spending and quickly assess where your money actually goes.

Food and Beverage (30-50% of budget)

Food and drinks consistently represent one of the largest expense categories. Recent benchmarking data showed that food and beverage accounts for nearly 30% of total conference budgets, with an average spend of $940 per attendee.

This kind of investment makes sense: 74% of event planners consider diverse culinary offerings important when selecting a venue, recognizing that quality food and beverages directly impact attendee satisfaction.

What this includes:

- Breakfast, lunch, and dinner service

- Coffee breaks and refreshment stations

- Snacks and beverages throughout the day

- Special dietary accommodations

- Service staff, gratuities, and taxes

Cost-saving strategies:

- Right-size portions based on historical attendance at each meal function

- Offer specialty beverages “on request” rather than over-ordering

- Lock in beverage pricing in your contract to avoid cost increases

- Consider food trucks or off-site options for select meals

Audio/Visual and Technology (15-17% of budget)

Technology costs have increased significantly in the last decade. AV costs now represent nearly 8% of event budgets for basic setups, while conferences typically allocate 15-17% for a more comprehensive AV infrastructure.

What’s more concerning: More than half (55%) of event planners expect AV costs to rise more than 20% in the near future. So, this is a line item in your budget to keep a close eye on now and into the future as costs potentially rise.

What this includes:

- Projection and display equipment

- Sound systems and microphones

- Lighting and staging

- Live streaming and recording capabilities

- Technical support staff

- Event management software and mobile apps

- Wi-Fi infrastructure

- Badge scanning and check-in technology

Cost-saving strategies:

- Choose venues with in-house AV equipment included in the package

- Negotiate transparent pricing upfront to avoid surprise charges

- Evaluate which sessions truly need recording versus live-only delivery

- Consider all-in-one event platforms versus multiple point solutions

Marketing and Promotion (10-20% of budget)

When allocating budget for event marketing, ensure your allocation scales based on event maturity. For example, for recurring events with established audiences, set aside 10-15% of your budget. For new events, increase that allocation to 15-20% since you’ll need to build awareness from scratch.

What this includes:

- Digital advertising (social media, search, display)

- Email marketing campaigns

- Promotional materials and graphics

- Event website or landing page development

- Content marketing

- Partner promotions

Cost-saving strategies:

- Leverage email lists and owned channels first

- Focus digital spend on platforms where your target audience is most active

- Use event management software with built-in marketing tools

- Partner with sponsors for co-marketing opportunities

Venue and Facilities

Venue costs represent one of the largest fixed expenses, but the sticker price varies dramatically by location, type of space, and what’s included in the basic package from the facility.

What this includes:

- Room rental for general sessions, breakouts, and networking spaces

- Setup and teardown services

- Tables, chairs, linens, and basic equipment

- Parking and facility access

- Security and cleaning services

Cost-saving strategies:

- Book venues 12-18 months in advance for better rates

- Consider secondary markets (Charlotte, Oklahoma City) versus primary markets (Chicago, San Francisco)

- Host events Sunday-Wednesday for lower rates

- Negotiate packages that bundle venue, food and beverage, and AV services

Speaker and Entertainment Costs

Signing top-notch speakers and attendee experiences aren’t categories where you want to cut corners for your conference budget. Food and beverage, AV, and speaker/entertainment combined should represent at least 55% of your total budget, as these categories have the most direct impact on attendee satisfaction.

What this includes:

- Speaker honorariums and fees

- Travel and accommodation

- Ground transportation

- Entertainment bookings

- Green room and speaker hospitality

Cost-saving strategies:

- Cultivate relationships with industry thought leaders willing to speak for exposure

- Offer non-monetary incentives like networking opportunities or content promotion

- Book local speakers to reduce travel costs

- Mix paid keynotes with volunteer subject matter experts

Event Management Software and Technology

Platform costs are typically fixed regardless of attendance levels, making them predictable budget items. Modern event management systems can reduce overall costs by automating manual processes and consolidating multiple tools.

What this includes:

- Registration and ticketing platform

- Mobile event app

- Virtual or hybrid event platform

- Payment processing fees

- Integration and setup costs

Contingency Fund (minimum 5%, aim for 10-15%)

Unexpected costs are inevitable—which is why you have to plan for the unplanned. Set aside at least 5% of your budget for a contingency fund to cover any expenses that pop up. Many planners prefer to allocate 10-15% of their budget for their contingency fund for larger or more complex events.

What this covers:

- Last-minute speaker cancellations and replacements

- Higher-than-expected vendor costs

- Lower-than-projected revenue

- Technology failures requiring quick solutions

- Additional services needed on-site

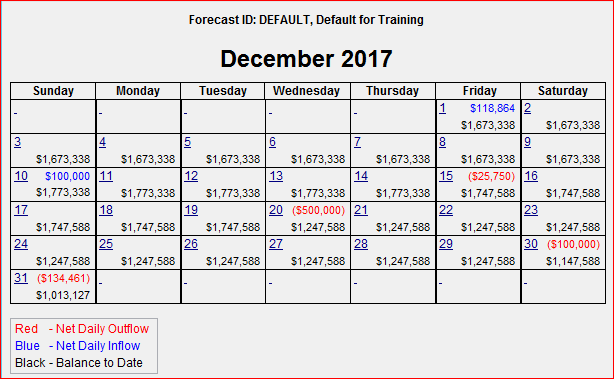

Phase 4: Build in Automation and Multi-Event Budgeting

Manual budget tracking consumes many precious hours (especially when planning multiple events a year) that stretched-thin planners don’t have. Instead of relying on data entry and manual tracking, organizations can offload key tasks to automation so planners can focus their efforts on strategic planning.

Cut down your event to-do list with these automation opportunities

- Automated invoicing: Generate and send invoices automatically based on registration or sponsorship commitments

- Real-time revenue dashboards: See current revenue versus projections without manual spreadsheet updates. Modern event registration platforms connect financial tracking directly to registration data

- Payment reminders: Automatic follow-ups for unpaid registrations or sponsorships

- Expense tracking: Connect vendor invoices directly to budget categories

Try These Tactics for Multi-Event Budgeting and Complex Event Portfolios

If you’re like other event planners we’ve worked with, you might be managing an average of 5-9 events per year—each requiring its own budget, vendor relationships, and financial tracking.

This means traditional single-event budgeting approaches just don’t scale. Planners need multi-event budgeting systems that introduce efficiencies and work across your entire portfolio:

- Side-by-side budget comparisons: Compare performance across different events to identify trends and opportunities

- Shared vendor contracts: Track negotiated rates that apply across multiple events

- Resource allocation dashboard: Monitor staff time and expenses across your event calendar

- Master cash flow calendar: Visualize revenue and expenses across all events to manage organizational cash flow

Multi-event budgeting transforms how you make strategic decisions—spotting which events drive the highest ROI, where to invest marketing dollars, and how to allocate limited staff resources across competing priorities.

The need for these systems is urgent: most event planners begin planning their next event within a week of completing the previous one, creating an endless cycle that demands efficient systems.

Association Event Budgets: Special Considerations for Nonprofits

Event planners at mission-driven organizations face unique budgeting challenges that corporate event managers don’t necessarily encounter. Creating an association conference budget requires accounting for member pricing, volunteer management, mission-driven constraints and a number of other unique factors.

When creating your association conference budget, consider the following:

Member vs. Non-Member Pricing

Budget impact: You must project your attendee mix accurately (for example, 70% members, 30% non-members). Revenue projections shift significantly if this mix changes.

Industry benchmarks suggest non-member pricing should be 20-36% higher than member pricing. ASAE benchmarking data shows a median markup of 25% on association products and services for non-members, with an average markup of 36%. IEEE standards require a minimum 20% differential.

Solution: Track registration split weekly and adjust projections as actual data comes in. Build scenarios in your budget for different mix percentages.

Board and Committee Meeting Costs

Many associations schedule board or committee meetings around their main conference. Don’t forget to budget for:

- Separate meeting space rental

- Food and beverage for closed meetings

- Board member travel and accommodations (if your organization covers these)

- Meeting materials and AV needs

Volunteer Recognition and Support

Volunteers are the backbone of association events—session moderators, committee members, track chairs. Budget for:

- Complimentary registrations (which impact gross revenue)

- Recognition reception or special event

- Gifts or awards for volunteers

- Volunteer coordinator staffing

Continuing Education Credit Administration

Healthcare, legal, and professional associations often provide CEUs or continuing education credits. This isn’t free, so you’ll need to consider:

- Administrative costs for processing credits

- Third-party accreditation fees

- Staff time for managing CE requirements

- Certificate printing and distribution

Membership Services During Event

Many associations run membership recruitment at their events, so you’ll need:

- On-site membership desk staffing

- New member sign-up promotions

- Membership materials and branded items

- Special offers or incentives for on-site joiners

Professional/Trade-Specific Considerations

Different industries carry their own unique costs:

- Healthcare/Medical: Keynote speakers in specialized fields command premium fees; industry-specific AV requirements for medical imaging displays

- Education: Accreditation and CE administration; educational materials and assessments

- Trade Associations: Exhibitor needs differ from academic conferences; regulatory compliance costs for certain industries

What Your Event Budget Template Should Include

A comprehensive event budget template should track:

- Revenue projections broken down by source (registration tiers, sponsorships, exhibitors, add-ons)

- Expense categories aligned with the cost breakdown above, with room for subcategories

- Tracking metrics including variance from budget, percentage spent by category, and revenue versus expenses

- Multi-event budgeting support if you’re running 2+ events annually, with the ability to compare performance across events

How to Track Your Conference Budget in Real Time with Budget Dashboards

Move Beyond Static Spreadsheets

Spreadsheets are a starting point, but they quickly become a liability as your event grows in complexity. Research shows over 42% of event planners work 15-20 hour days during the planning process—and administrative tasks consume much of this time. Instead, teams can leverage modern systems to automate many repetitive tasks.

The spreadsheet problem:

- Version control chaos (“Budget_Final.xlsx” vs. “Budget_Final_v2.xlsx”)

- Manual updates required for every registration

- Data spread across multiple files

- Team collaboration conflicts

- No real-time visibility—it takes hours to compile status reports

- Human errors and miscalculations are costly

- Time spent on spreadsheets means less time for strategy

- Delayed decisions due to lack of current data

If you’re struggling with these challenges, modernizing your budget process can transform how your team manages finances across multiple events.

Get the Conference Budget Dashboard Advantage

A real-time event budget dashboard transforms how you manage finances. Instead of waiting days or weeks for updated reports, modern conference budget dashboards provide:

- Automatic updates as registrations come in—no manual data entry required

- Single source of truth for the entire team with simultaneous access

- Instant answers to “Where do we stand?” questions from leadership

- Early problem detection when solutions are easier and less expensive to implement

- Visual progress tracking that makes complex financial data immediately understandable

Real-time event budget tracking eliminates the lag time between when money moves and when you know about it. This visibility enables faster, smarter decision-making throughout your event planning cycle. Comprehensive event management software integrates budget dashboards with registration, sponsorship, and attendee management so you’re tracking your finances all in one platform.

Monitor These 5 Key Metrics Weekly

- Registration pace versus projections: Are you on track to hit attendance goals?

- Revenue per registrant: Is your average ticket price holding up, or are discounts eating into margins?

- Sponsorship commitment rate: What percentage of sponsor targets have you secured?

- Expense burn rate: Are you spending at the expected pace, or accelerating too quickly?

- Category budget variance: Which categories are over or under budget?

Make Adjustments Based on Data

Benchmark your performance against these industry averages:

- 45% register less than 4 weeks before the event

- 26% register in final 2 weeks

- 9% register on-site

- Website conversion benchmarks: 15-25% of event page visitors should register

- Virtual event attendance conversion: 50% of registrants attend virtual events

If you’re significantly off these benchmarks, investigate why and adjust your strategy.

Cut These Costs, If Needed

If revenue underperforms against your projections, you can make a few strategic cuts that won’t hurt attendee experience:

- Switch printed programs to digital-only (mobile app or PDF)

- Simplify swag bags—fewer, better items rather than a higher quantity of items

- Negotiate better rates with current vendors using your relationship leverage

- Reduce special events or make some optional add-ons

Avoid These Common Conference Planning Budget Pitfalls

Underestimating Hidden Costs

It’s easy to miss some of the hidden fees that can pop up at various points in the planning process. Don’t overlook these common invisible expenses:

- AV setup fees

- Wi-Fi upgrades

- Shipping and freight

- Electrical hookups

- Security requirements

- Insurance

- Permit fees

Failing to Track Registration Revenue in Real-Time

Waiting until month-end to check your registration status means you can’t course-correct when it matters most.

Real-time event budget tracking provides the visibility needed to make adjustments while there’s still time to impact outcomes. Implement daily or weekly tracking at minimum.

Spreadsheet Chaos Across Multiple Events

Managing budgets for 3+ events in separate spreadsheets is a recipe for errors and wasted time. Consolidate into a single system.

Not Accounting for Last-Minute Attendee Changes

Late registrations and last-minute cancellations affect F&B guarantees, materials printing, and space requirements. Build flexibility into vendor contracts.

Not Negotiating Vendor Contracts

Everything is negotiable. Request package deals, waive setup fees, negotiate better payment terms, and ask for discounts on multi-year commitments.

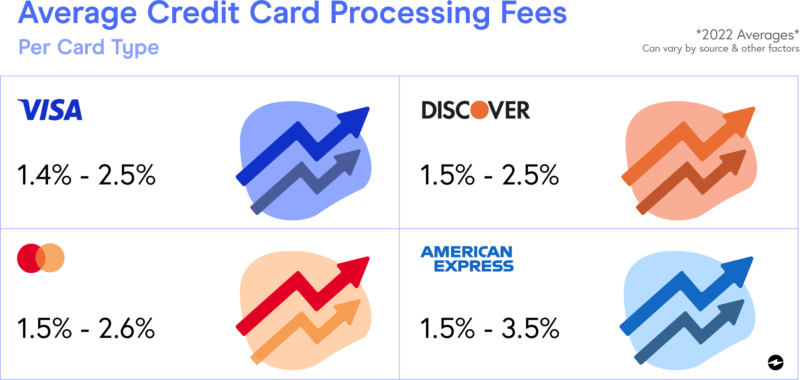

Forgetting Credit Card Processing Fees

Payment processing typically costs 2.5-3.5% of each transaction. On a $500,000 event, that’s $12,500-17,500 in fees. Ensure you have a line item in your budget for these fees.

Ignoring Historical Data

One accurate predictor of future event performance is past performance. Review your previous event budgets for actual costs, attendance patterns, and registration timing. Use this data to build more accurate projections.

Common Conference Budget Questions

How much should I budget per attendee?

Per-attendee costs depend on the length of the event, the format, and the scale.

• Daily meeting costs: $169/day per attendee

• Large conference cost: $3,144 per person

Registration fees by scale:

• Small/local: $200-500

• Mid-sized: $500-1,000

• Large/premium: $1,000+

What percentage of my event budget should go to marketing?

The amount you need for marketing will depend on the event’s maturity level:

• 10-15% for recurring events with strong historical attendance

• 15-20% for new events that need to build awareness

You can increase these amounts if you’re entering a highly competitive market, targeting new audience segments, or competing against well-established events with larger marketing budgets.

How should I price conference registration?

Use a tiered pricing strategy:

• Early bird: 10-25% discount off standard pricing

• Standard: Full price baseline (where most registrations occur)

• Late/onsite: 15-20% premium over standard pricing

• Member vs. non-member (for associations): 20-36% differential. ASAE data suggests a median markup of 25%, with an average of 36%. IEEE requires a minimum 20% differential.

Should I build my own conference budget template or use event management software?

Depends on event volume and team capacity:

Build your own event budget template if:

• You manage only one event per year

• Budget is under $50,000

• Team has time for 12-15 hours of manual updates per event

• You have strong Excel skills and version control processes

Use event management software with real-time budget dashboards if:

• You manage 2+ events per year

• Budget is $100,000+

• You need real-time visibility, not week-old data

• Multiple team members need simultaneous access to financial data

• You want automated reporting for stakeholders

Learn more about event registration software with integrated financial tracking.

What’s a realistic profit margin for conferences?

According to the Event Management Institute, healthy event profit margins typically range from 10-25%, though targets vary based on mission and goals.

Factors affecting your target:

• Mission priority: Revenue generation versus community service or member benefit

• Event maturity: Established conferences with loyal audiences versus new events

• Revenue diversity: Multiple income streams enable higher margins

• Portfolio approach: Balance profit and loss across your full event calendar

How much should I set aside for a contingency fund for my event?

Recommended contingency: minimum 5%, aim for 10-15% of total budget.

Set aside contingency funds at the start, not as an afterthought. Track contingency usage across events to refine future estimates. For high-risk situations (outdoor events, international venues, first-time locations), consider event cancellation insurance beyond your contingency fund.

Gain Real-Time Visibility Into Your Conference Budget

Effective conference budget management is about creating systems for real-time visibility into your finances, not just tracking expenses in spreadsheets. The most successful event planners focus on automation over administration, using conference budget dashboards and real-time event budget tracking to empower their teams. This approach lets planners concentrate on strategy and attendee experience rather than data entry and manual calculations.

Start with a solid conference budget template, track the right metrics in real time, avoid common pitfalls, and invest in tools that scale with your event portfolio. Event registration platforms with integrated financial dashboards streamline the entire budget management process. Whether you’re planning your first 100-person workshop or managing multi-event budgeting across a dozen annual conferences, these principles will help you deliver exceptional events while maintaining financial health.