Grant reporting is a crucial aspect of the nonprofit world, as it enables organizations to demonstrate their impact and accountability to funders. However, many nonprofits struggle with creating effective grant reports that accurately reflect their work and progress toward their goals.

Here, we will explore some best practices for nonprofit grant reporting, including how to create clear and concise reports. When you follow these guidelines, your nonprofit can create informative and compelling grant reports, helping you to secure future funding and build a stronger foundation for your work.

What Is a Grant Report?

A grant report is a document that provides an account of how funds from a grant have been utilized, the results or accomplishments achieved, and the impact the grant has had on the project or organization.

The grant provider typically requires grant reports to ensure that the funds have been used appropriately and effectively. The purpose of a grant report is to provide accountability, transparency, and learning for the grant provider, the grant recipient, and any other stakeholders.

What Should You Include in a Grant Report?

The format and content of a grant report can vary depending on the specific requirements of the grant provider; however, it typically includes the project’s objectives, activities, budget, and outcomes. The report may also include qualitative and quantitative data, such as performance indicators, metrics, and testimonials, to demonstrate the effectiveness of the project or program.

When creating a grant report, there are several essential elements that you should include to provide a clear and comprehensive account of the grant’s impact and how the funds were used. Here are some key elements to consider:

- Introduction: Begin by introducing the project or program that the grant supported, including its purpose, objectives, and a brief overview of the activities.

- Budget: Provide a breakdown of the grant funds received and how they were used. This should include an itemized list of expenses and how each expense contributed to the success of the project.

- Accomplishments: Describe the achievements and outcomes of the project. Include both quantitative and qualitative data to demonstrate the project’s impact. This can include factors such as the number of people served, changes in behavior, or improvements in key indicators.

- Challenges: Report any obstacles encountered during the project and describe how they were addressed. This could include unexpected barriers, changes in circumstances, or unforeseen events.

- Lessons learned: Discuss any lessons that were learned during the project. This can include insights into what worked well and what could be improved, as well as suggestions for future projects.

- Conclusion: Summarize the project’s overall impact and the value of the grant support. Thank the grant provider for their support and express your appreciation for the opportunity to undertake the project.

Remember that the specific format and content of a grant report may vary depending on the grant provider’s requirements, so it is essential to review the guidelines carefully and follow them closely.

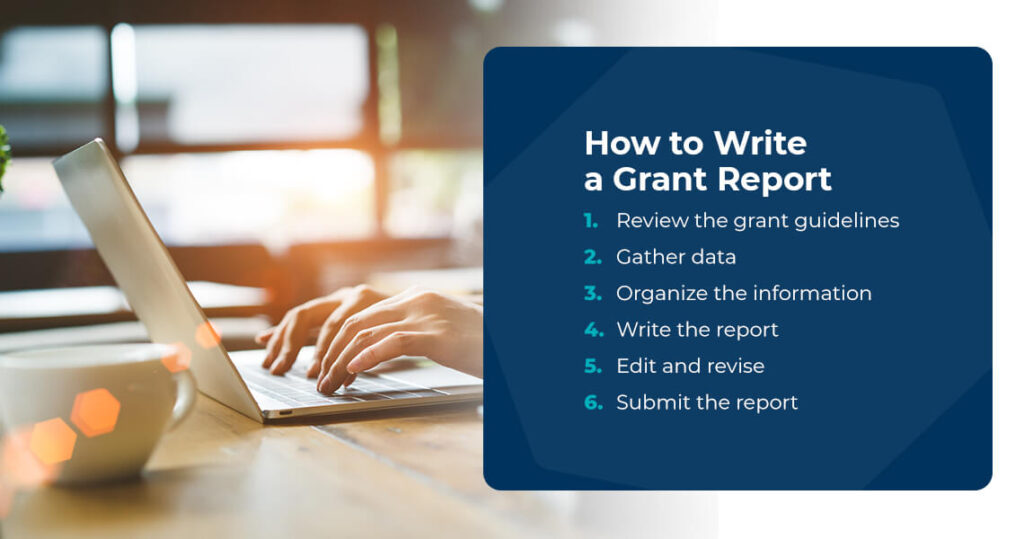

How to Write a Grant Report

Writing a grant report can seem overwhelming, but with a clear plan and attention to detail, you can create a thorough and effective report. Here are some steps to follow when writing a grant report:

- Review the grant guidelines: Before you begin writing, carefully review the guidelines given by the grant provider. Make note of any specific requirements or instructions for the report, such as the format, length, or content.

- Gather data: Collect all relevant data and information related to the project or program that the grant supported. This could include budget information, project reports, and any other documents related to the project.

- Organize the information: Create an outline or framework for the report based on the guidelines and the information you’ve gathered. This will help you organize the information clearly and logically.

- Write the report: Using your outline as a guide, begin drafting the report.

- Edit and revise: Once you’ve written the report, carefully review it for accuracy, clarity, and completeness. Make any necessary revisions and edits, and proofread the document for spelling and grammar errors.

- Submit the report: Submit the grant report to the grant provider according to their guidelines and deadlines.

Remember to be honest and transparent in your grant report, providing as much detail as possible to demonstrate the project’s impact and the value of the grant support.

Grant Reporting Best Practices

Here are some best practices to consider when writing a grant report:

- Follow the guidelines: Review the grant provider’s guidelines carefully and ensure that you meet all of their requirements. This may include specific formatting, length, or content requirements.

- Be honest and transparent: Provide an accurate and transparent account of how the grant funds were utilized and the project’s impact. Avoid exaggerating or making claims that can’t be supported by data.

- Provide data and evidence: Use data and evidence to support your claims about the impact of the project. This can include both quantitative and qualitative data, such as performance indicators, testimonials, and case studies.

- Be concise and focused: Stick to the key points and avoid including unnecessary information or irrelevant details. Use clear and concise language to communicate your message effectively.

- Address challenges and lessons learned: Discuss any challenges or obstacles that were encountered during the project, and describe how they were addressed. Similarly, share any lessons learned from the project that may be useful for future projects.

- Include a summary and conclusion: Summarize the key points of the report and provide a conclusion that highlights the value of the grant support and the impact of the project.

- Be on time: Submit the grant report on time or even earlier than the deadline to avoid any delays or complications. Late submissions can affect future funding opportunities.

By following these best practices, you can create a comprehensive and effective grant report that effectively demonstrates the project’s impact and the value of the grant support.

Request a Demo for Nonprofit Grant Reporting

MIP Accounting® is a software system designed specifically for nonprofit organizations. It can help with nonprofit grant reporting in several ways:

- Tracking grant funds: Our system allows nonprofits to track grant funds separately from other funds, making it easier to monitor and report on the use of grant funds.

- Generating detailed financial reports: Our solution can generate detailed financial reports tailored to meet the specific needs of a grant report. This can include reports on budget vs. actual spending, project expenses, and other financial metrics that are important for grant reporting.

- Ensuring compliance with grant regulations: Our software solution can also help ensure compliance with grant regulations by tracking expenses and verifying that they align with the grant’s requirements. This can help prevent errors and discrepancies in grant reporting.

- Streamlining reporting processes: We can streamline the grant reporting process by automating data entry and report generation. This can save time and reduce the risk of errors or omissions in the report.

- Facilitating audits: Our system can help facilitate audits by providing accurate and detailed financial data that can be easily accessed and reviewed by auditors.